Trading cryptocurrencies can be tough, especially when you worry about costs. Our affordable cryptocurrency trading platform gets it. We aim to keep fees low without sacrificing security or service quality.

Exchanges like Kraken and Gemini show us how it’s done with their competitive fees. We’re dedicated to following their lead. Our platform offers seamless transactions and advanced security features. It’s perfect for traders.

Key Takeaways

- Competitive fees without compromising on security

- Seamless and efficient transaction processes

- Advanced security features to protect user assets

- User-friendly interface for a smooth trading experience

- Reliable and efficient customer support

Understanding Low-Fee Crypto Exchanges

The crypto market is changing fast. More people want budget-friendly digital asset exchanges. Now, traders look for exchanges with low fees.

What Are Low-Fee Crypto Exchanges?

Low-fee crypto exchanges offer competitive fees for crypto trading. This lets traders keep more of their profits. High fees can cut into gains, especially for those who trade often.

Platforms like Coinbase and Binance are good examples. Coinbase charges between 0%-3.99%. Binance gives a 25% discount with BNB.

Benefits of Choosing a Low-Fee Option

Choosing a budget-friendly digital asset exchange has many benefits. It helps traders maximize their trading profits. This is great for those who trade often.

Lower fees mean traders can explore different assets without big costs. This makes it easier to grow their portfolios.

| Exchange | Fee Structure | Discounts |

|---|---|---|

| Coinbase | 0%-3.99% | None |

| Binance | Variable | 25% with BNB |

How Fees Impact Your Trading Experience

Fees can really affect your trading experience. High fees can cut into your profits. It’s key to pick an exchange with competitive fees for crypto trading.

By choosing a low-fee exchange, traders can save money. This makes trading more flexible and profitable.

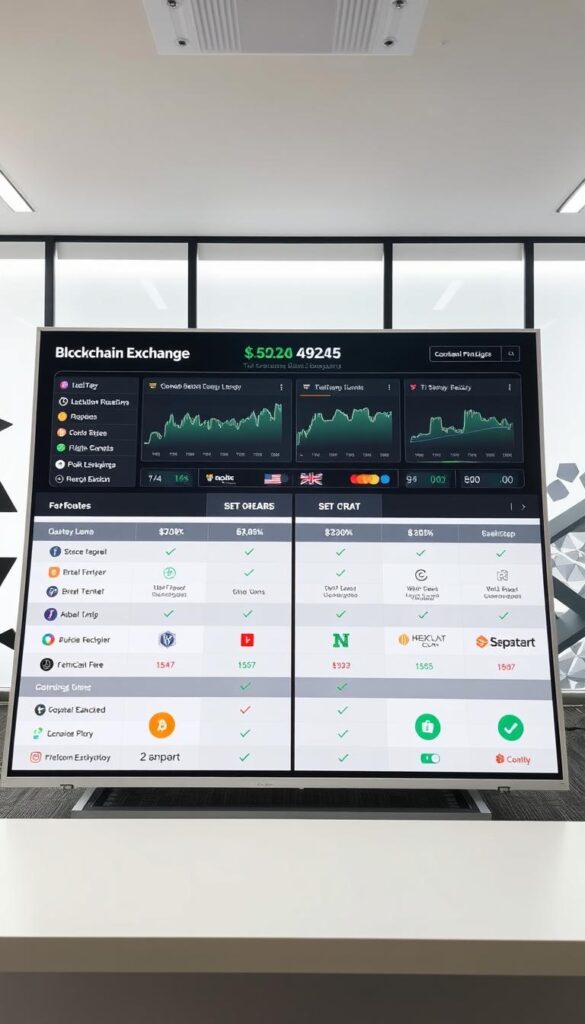

How We Compare Various Platforms

It’s important to compare different crypto exchanges to find the best one for you. There are many platforms out there, each with its own features and fees. Doing a detailed comparison helps you make smart choices.

Key Features to Look For

When looking for a good crypto platform, there are key features to check. These include:

- Security Measures: Good security to keep your assets safe.

- Fee Structure: Clear and fair fees.

- User Interface: Easy to use and understand.

- Customer Support: Quick and helpful service.

- Trading Tools: Useful tools for trading.

Our Criteria for Evaluation

We look at several important factors when comparing platforms. Our criteria include:

- Fee Transparency: Clear fees.

- Security: Strong security measures.

- User Experience: Easy to use.

- Customer Support: Good and quick support.

- Trading Volume: Good liquidity and volume.

By looking at these, we can fully understand what each exchange offers.

Popular Low-Fee Platforms Reviewed

Some exchanges are known for their low fees and strong security. Kraken Pro and Gemini ActiveTrader are examples. Kraken Pro charges 0.16%-0.26%, while Gemini ActiveTrader charges 0.20%-0.40%. These platforms show how you can get low fees and good security together.

Our review of these platforms shows their unique features and fees. This helps traders make better choices.

Security Measures We Should Consider

Security is key in the world of cryptocurrency trading. As we explore crypto exchanges, we must focus on strong security. This protects our assets and personal data.

Importance of Security in Crypto Trading

Crypto trading comes with big risks. Security breaches can cause big financial losses. Exchanges like Gemini and Coinbase lead by focusing on security. Gemini offers FDIC insurance, and Coinbase has strong security.

When picking a crypto exchange, look at its security. Make sure it meets your standards for protecting your assets.

⭐️ Tap the exclusive deal link https://temu.to/k/uot8tcxvwum to score top-quality items at ultra-low prices. 🛍️ These unbeatable deals are only available here. Shop now and save big! ⭐️ Directly get exclusive deal in Temu app here: https://app.temu.com/m/mhb5rstagbx

Another surprise for you! Click https://temu.to/k/uag0bn0o0wd to earn with me together🤝!

Common Security Features to Look For

A secure crypto exchange should have several key features:

- Two-Factor Authentication (2FA): Adds an extra layer of security to user accounts.

- Encryption: Protects user data and transactions from unauthorized access.

- Cold Storage: Stores the majority of user assets offline, reducing the risk of hacking.

- Regular Security Audits: Ensures the exchange’s security protocols are up-to-date and effective.

Checking these features helps us see if the exchange is serious about security.

Red Flags: Signs of a Potentially Unsecure Platform

When checking a crypto exchange, watch out for these red flags:

| Red Flag | Description |

|---|---|

| Lack of Transparency | The exchange is unclear about its security measures or team. |

| Poor User Reviews | Users report security concerns or issues with fund withdrawals. |

| Unregistered Operations | The exchange operates without proper regulatory compliance. |

Knowing these red flags helps us choose wisely when picking a crypto exchange.

By focusing on security, we can have a safer trading experience. This is on a discounted crypto trading service that also offers value-for-money crypto exchange features.

User Experience on Low-Fee Exchanges

Trading on a low fee crypto exchange platform should be easy. It’s important for you to move around and use the platform well. The experience includes the interface, customer support, and how it works on both mobile and desktop.

Platforms like Crypto.com and Coinbase are easy to use. Crypto.com has a cool mobile app. Coinbase helps users learn with educational resources.

The Importance of an Intuitive Interface

An intuitive interface is key for a good experience. It lets traders get started fast and feel good about using the platform. A good interface is simple, with everything labeled clearly and easy to find.

Customer Support: What We Expect

Good customer support is essential. Traders want quick and helpful answers. Low-fee exchanges should have live chat, email, and FAQs to help.

Mobile vs. Desktop Experience

The choice between mobile and desktop is up to you. Desktops give more details and space, but mobile apps are handy on the go. A good exchange should work well on both.

What you prefer depends on how you trade. A top low-fee exchange will make sure both mobile and desktop are easy to use.

Understanding Transaction Fees and Structures

Getting to know transaction fees is key for effective crypto trading. Fees can greatly affect your trading, so it’s important to understand them well.

Types of Fees in Crypto Exchanges

Crypto exchanges have different fees, like maker and taker fees. Maker fees are for those who add liquidity with limit orders. Taker fees are for those who take liquidity with market orders.

High-volume traders can get discounts on fees. For example, some exchanges offer lower fees as your trading volume grows.

How Fees are Calculated

Fees are based on the order type and volume. For instance, a taker fee might be 0.1% of the trade value. Maker fees could be 0.05%. There are also withdrawal fees for moving cryptocurrencies out of your wallet.

| Exchange | Maker Fee | Taker Fee | Withdrawal Fee |

|---|---|---|---|

| Exchange A | 0.05% | 0.1% | $5 |

| Exchange B | 0.02% | 0.08% | $3 |

| Exchange C | 0.01% | 0.07% | $2 |

Hidden Fees: What to Watch For

While most exchanges are clear about fees, some hide costs. Look out for inactivity fees, deposit fees, or fees for extra services. Always check the exchange’s fee schedule to know all costs.

- Inactivity fees: charged for inactive accounts.

- Deposit fees: charged for depositing funds.

- Service fees: for extra services like fast withdrawals.

Knowing about these fees helps you pick an economical blockchain exchange. This way, you can meet your trading needs without extra costs.

How to Get Started on a Low-Fee Crypto Exchange

Starting your crypto trading journey means picking the right exchange. A low-fee crypto exchange is a cost-effective cryptocurrency platform that makes trading better. We’ll show you how to set up your account, verify it, and fund it on a discounted crypto trading service.

Setting Up Your Account

Setting up an account on a low-fee crypto exchange is easy. Sites like Coinbase and Binance have simple interfaces. You just need to give basic info like your email and password. Some exchanges might ask for ID documents for verification.

Here’s how to set up your account:

- Go to the exchange’s website and click “Sign Up”.

- Enter your email and create a strong password.

- Check your email for a confirmation link from the exchange.

- Fill in more details like your name and phone number.

Verification Process Explained

The verification process is key for exchange security and compliance. You’ll need to send ID documents like a passport or driver’s license. Some exchanges also ask for proof of address.

Verification levels differ among exchanges. Higher levels give more features, like higher withdrawal limits.

| Verification Level | Requirements | Benefits |

|---|---|---|

| Basic | Email verification | Limited trading and withdrawal |

| Intermediate | ID verification | Increased trading and withdrawal limits |

| Advanced | ID and proof of address | High trading and withdrawal limits |

Funding Your Account: Tips and Tricks

After setting up and verifying your account, fund it. Binance and others offer bank transfers, cards, and crypto. The funding method affects fees.

Here are tips for funding:

- Pick a funding method with low fees.

- Know the processing times for each method.

- Use a hardware wallet for extra security with crypto.

By following these steps and tips, you can efficiently start trading on a low-fee crypto exchange. This way, you can trade more and spend less.

Strategies for Trading on a Low-Fee Platform

Trading on a low-fee crypto exchange needs a good plan. Platforms like Kraken Pro help you earn more by cutting down trading costs. Here, we’ll look at how to get the most from your trades on a cost-effective crypto exchange.

Optimal Trading Strategies

To trade well, you must pick strategies that fit your goals and how much risk you can take. Some top strategies include:

- Using limit orders to control the price at which you buy or sell cryptocurrencies

- Employing dollar-cost averaging to reduce the impact of market volatility

- Setting stop-loss orders to limit potential losses

These methods help you move through the markets better and keep your investments safe.

Utilizing Tools and Resources

Low-fee crypto exchanges give you many tools and resources. For example, Kraken Pro has advanced charts, real-time data, and different order types. Using these tools helps you make better trading choices and improve your results.

Risk Management Practices

Good risk management is key to trading success. It’s not just about setting stop-loss orders. It also means spreading out your investments and controlling how much you borrow. With strong risk management, you can keep your money safe and avoid big losses.

Trading on a low-fee platform needs the right strategies, using tools well, and smart risk management. By focusing on these, you can make your trading better and possibly earn more on a cheap digital currency trading platform.

Common Mistakes to Avoid in Crypto Trading

Trading in crypto requires knowing common pitfalls. Traders often forget about security or overlook fees. Some exchanges have complex fee structures. Knowing these mistakes can improve your trading on a low-fee crypto exchange platform.

Overlooking Fee Structures

Many traders ignore the fees of their chosen exchange. Different exchanges have different fees for transactions, withdrawals, and more. It’s important to know the fee schedule to avoid surprises.

- Transaction fees: These can vary based on the type of transaction and the exchange’s policies.

- Withdrawal fees: Some exchanges charge high fees for withdrawing your earnings.

- Hidden fees: Look out for any additional fees that might not be immediately apparent.

For example, some exchanges might charge more for certain transactions or at specific times. Knowing this can help you plan better.

Neglecting Security Best Practices

Security is key in crypto trading. Ignoring security best practices can put you at risk. Here are some important security steps:

- Enable two-factor authentication (2FA) to add an extra layer of security to your account.

- Use strong, unique passwords for your trading accounts.

- Regularly update your passwords and security settings.

By following these steps, you can lower the risk of your account being hacked.

Failing to Research Platforms Thoroughly

Before picking a crypto exchange, do your homework. Research the exchange’s reputation, user reviews, and security. Consider these factors:

| Feature | Description | Importance |

|---|---|---|

| Reputation | Check user reviews and ratings | High |

| Security | Look for robust security measures like 2FA and encryption | High |

| Fees | Understand the fee structure for transactions and withdrawals | Medium |

By carefully checking these points, you can find a reliable and affordable cryptocurrency trading platform that fits your needs.

The Future of Low-Fee Crypto Exchanges

The crypto market is changing fast, thanks to DeFi and more people using it worldwide. Low fees for trading will be key in the future of this industry.

Now, we see a move towards exchanges that are cheaper and focus on user experience and safety. This trend will keep growing, with new ideas to cut costs and make trading smoother.

Emerging Trends in the Market

DeFi has changed crypto exchanges a lot. As DeFi grows, we’ll see more platforms with good fees and new trading tools.

Innovations Shaping the Industry

New tech and business models are coming, making crypto trading cheaper and easier. Now, people want exchanges that are affordable and safe.

Future Outlook

The market will keep getting better, with lower fees and better exchange operations. The future of low-fee crypto exchanges looks bright, aiming for a more open and efficient trading space.