Trading in financial markets demands constant attention, quick decision-making, and disciplined execution. But what if you could automate this process, following the strategies of successful traders without being glued to your screen? MetaTrader 4 Trading Signals with Automatic Execution offer exactly this solution, allowing you to mirror the trades of experienced professionals directly on your account.

In this comprehensive guide, we’ll explore how MT4 signals work, walk through the setup process, compare the benefits against manual trading, and recommend reliable signal providers to get you started on your automated trading journey.

What Are MT4 Trading Signals and How Automatic Execution Works

MetaTrader 4 Trading Signals are a copy-trading service that allows you to automatically replicate the trades of experienced traders (signal providers) on your own trading account. When a provider executes a trade, the same trade is automatically mirrored in your account, maintaining the same proportions relative to your account balance.

How Automatic Execution Works

The automatic execution system works through a sophisticated synchronization mechanism between the signal provider’s account and your subscriber account:

- Signal providers connect their trading accounts to the MQL5 signal service

- Subscribers select and subscribe to signals that match their trading preferences

- When a provider opens, modifies, or closes a position, these actions are transmitted to the signal service

- The signal service then relays these commands to all subscriber accounts

- Your MT4 terminal executes these commands automatically, replicating the provider’s trades

This entire process typically occurs within seconds, ensuring that your account closely mirrors the performance of your chosen signal provider. The execution happens server-side, meaning your MT4 terminal doesn’t even need to be running for the trades to be copied.

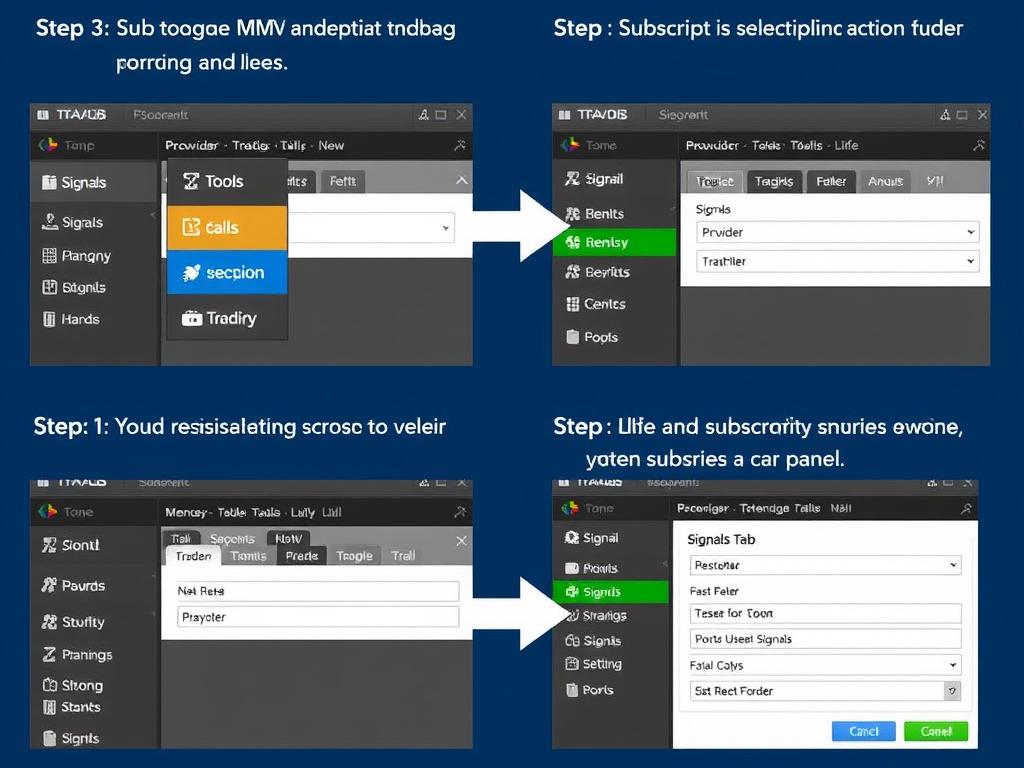

Step-by-Step Setup Guide for MT4 Trading Signals with Automatic Execution

Setting up MetaTrader 4 Trading Signals with Automatic Execution is straightforward. Follow these steps to connect signals to your trading account:

-

Update your MT4 platform

Ensure you’re running the latest version of MetaTrader 4 to access all signal features.

-

Create an MQL5.com account

Register at MQL5.com using the same email associated with your MT4 platform.

-

Access the Signals marketplace

In MT4, click on “Tools” in the top menu, then select “Options” → “Community” → “Signals” or navigate directly to the Signals tab.

-

Browse and select a signal provider

Review performance metrics, trading history, and reliability scores to find a suitable provider.

-

Subscribe to your chosen signal

Click “Subscribe” and complete the payment process (typically a monthly subscription fee).

-

Configure signal settings

Set your risk parameters, including maximum deposit percentage to risk and whether to copy existing open trades.

-

Confirm and activate

Verify all settings and activate the signal subscription to begin automatic trade copying.

Ready to Start Copying Professional Traders?

Access the MT4 Signals marketplace and find signal providers that match your trading goals and risk tolerance.

Benefits of Automated Signal Execution vs. Manual Trading

Advantages of Automated Signal Execution

- Trades execute 24/7 without your constant attention

- Eliminates emotional decision-making and trading psychology issues

- No missed trading opportunities due to being away from your computer

- Precise entry and exit points based on professional strategies

- Ability to diversify by following multiple signal providers

- Transparent track record of signal provider performance

- Learn from successful traders by observing their strategies

Limitations of Manual Trading

- Limited trading hours based on your availability

- Susceptible to emotional decisions and trading biases

- Missed opportunities when you’re not monitoring the market

- Inconsistent execution of trading strategies

- Steep learning curve for developing profitable strategies

- Time-consuming market analysis and trade management

- Difficulty in maintaining trading discipline

⭐️ Tap the exclusive deal link https://temu.to/k/uot8tcxvwum to score top-quality items at ultra-low prices. 🛍️ These unbeatable deals are only available here. Shop now and save big! ⭐️ Directly get exclusive deal in Temu app here: https://app.temu.com/m/mhb5rstagbx

Another surprise for you! Click https://temu.to/k/uag0bn0o0wd to earn with me together🤝!

Mark, a retail trader from Chicago, shares his experience: “Before using MT4 signals with automatic execution, I was constantly stressed about missing trades while at work. Now my account trades 24/5 following strategies I could never implement myself. My monthly returns have increased by 12% while I spend 90% less time actively trading.”

Risk Management Strategies for Auto-Executed Signals

While automated signal execution offers many advantages, proper risk management is essential to protect your capital. Implement these strategies to trade safely with MT4 signals:

Set Maximum Risk Limits

Configure your signal subscription to risk only a small percentage (1-3%) of your account balance per trade. This prevents catastrophic losses from any single position.

Use Multiple Signal Providers

Diversify your automated trading by following multiple signal providers with different strategies and trading styles to spread risk across various approaches.

Monitor Performance Regularly

Review your signal providers’ performance weekly. Look for changes in trading patterns or risk behavior that might warrant unsubscribing.

Start With a Demo Account

Test signal providers on a demo account before committing real capital. This allows you to evaluate their performance without financial risk.

Implement Additional Stop-Loss

Consider setting account-wide stop-loss limits that will halt trading if your account drawdown exceeds predetermined thresholds.

Adjust Copy Ratio

Modify the copy ratio to trade smaller lot sizes than the signal provider if their risk tolerance exceeds yours.

Pro Tip: Create a dedicated trading account specifically for signal copying. This allows you to precisely control how much capital you allocate to automated trading while keeping your manual trading separate.

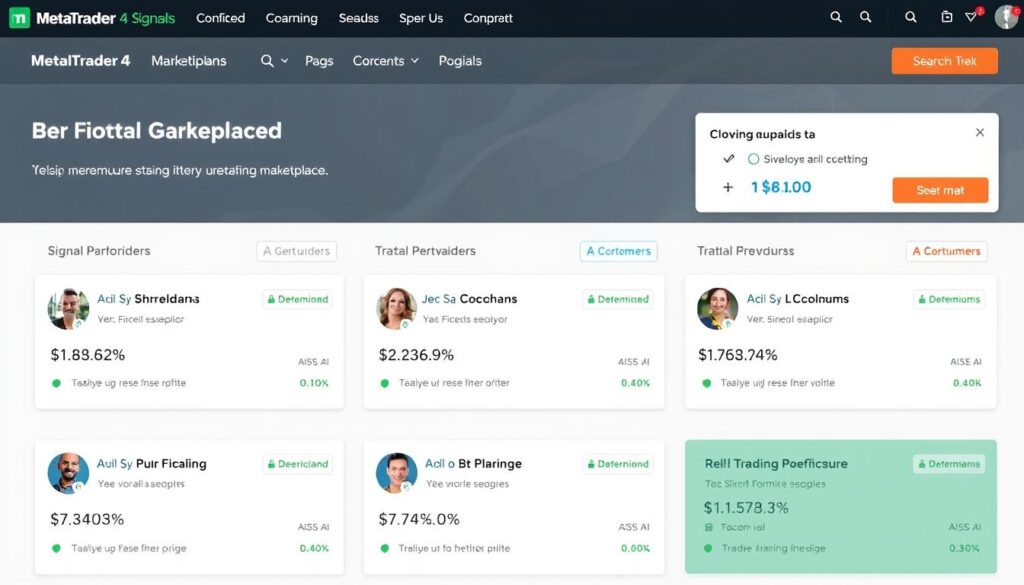

Top 3 Recommended MT4 Signal Providers with Automatic Execution

Based on performance history, reliability, and subscriber satisfaction, here are three recommended MT4 signal providers that offer automatic execution:

1. Annic

Growth: 2,284% since 2021

Trading Style: Algorithmic trading (92% of trades)

Instruments: Major forex pairs with focus on EUR/USD and GBP/USD

Average Trades: 15-20 per week

Why We Recommend: Annic offers consistent performance with moderate risk and high reliability. Their algorithmic approach provides disciplined trading with minimal emotional interference, making it ideal for beginners and experienced traders alike.

2. Night Club

Growth: 414% since 2020

Trading Style: 100% algorithmic trading

Instruments: Diversified across forex, indices, and commodities

Average Trades: 8-12 per week

Why We Recommend: Night Club stands out for its perfect 100% reliability score and consistent performance across various market conditions. Their diversified approach across multiple instruments provides excellent portfolio balance and reduced correlation risk.

3. MCA100

Growth: 595% since 2023

Trading Style: 100% algorithmic trading

Instruments: Primarily focused on gold (XAU/USD)

Average Trades: 5-10 per week

Why We Recommend: MCA100 has achieved impressive growth in a short period while maintaining perfect reliability. Their specialized focus on gold trading demonstrates expertise in a specific market niche, making them ideal for traders looking to add gold exposure to their portfolio.

Selection Criteria: These providers were selected based on growth performance, reliability scores above 90%, consistent trading history of at least 6 months, transparent trading statistics, and positive subscriber reviews.

Troubleshooting Common Issues with MT4 Signal Synchronization

Even with a robust platform like MetaTrader 4, you may occasionally encounter synchronization issues with trading signals. Here are solutions to the most common problems:

| Issue | Possible Cause | Solution |

| Trades not copying | Insufficient account balance or leverage restrictions | Ensure your account has adequate funds and compatible leverage settings with the signal provider |

| Delayed trade execution | Slow internet connection or broker server issues | Check your internet connection, consider using a VPS for more reliable connectivity |

| Different entry prices | Slippage or different broker pricing | Choose signal providers who use the same broker as you, or accept minor price differences |

| Signal subscription inactive | Subscription payment failed or expired | Verify your subscription status and payment method in the MQL5 community |

| MT4 terminal disconnecting | Computer sleep settings or unstable connection | Use a VPS service to keep your MT4 running 24/7 without interruptions |

Important: If you’re experiencing persistent synchronization issues, contact your broker’s support team first, as they can verify if there are any account restrictions preventing proper signal copying.

Frequently Asked Questions

What causes execution delays with MT4 trading signals and how can I minimize them?

Execution delays with MT4 trading signals can be caused by several factors:

- Internet connectivity issues – Unstable connections can delay signal transmission

- Broker server response time – Some brokers process orders more slowly than others

- High market volatility – During major news events, execution can be delayed due to rapid price changes

- MT4 terminal performance – An overloaded or outdated terminal may process signals slowly

To minimize delays, consider using a Virtual Private Server (VPS) located near your broker’s servers, ensure your MT4 platform is updated to the latest version, and choose a broker known for fast execution speeds. For critical trading, a dedicated internet connection can also help reduce latency.

What are the minimum deposit requirements for using MT4 trading signals with automatic execution?

The minimum deposit requirements vary depending on several factors:

- Signal provider requirements – Some providers recommend minimum account sizes based on their trading strategy and risk profile

- Broker minimum deposits – Your broker may have their own minimum deposit requirements, typically ranging from 0 to 0

- Practical considerations – For effective risk management, you should have enough capital to withstand drawdowns

As a general guideline, while you can technically start with as little as 0-0, a more practical minimum would be 0-

Frequently Asked Questions

What causes execution delays with MT4 trading signals and how can I minimize them?

Execution delays with MT4 trading signals can be caused by several factors:

- Internet connectivity issues – Unstable connections can delay signal transmission

- Broker server response time – Some brokers process orders more slowly than others

- High market volatility – During major news events, execution can be delayed due to rapid price changes

- MT4 terminal performance – An overloaded or outdated terminal may process signals slowly

To minimize delays, consider using a Virtual Private Server (VPS) located near your broker’s servers, ensure your MT4 platform is updated to the latest version, and choose a broker known for fast execution speeds. For critical trading, a dedicated internet connection can also help reduce latency.

What are the minimum deposit requirements for using MT4 trading signals with automatic execution?

The minimum deposit requirements vary depending on several factors:

- Signal provider requirements – Some providers recommend minimum account sizes based on their trading strategy and risk profile

- Broker minimum deposits – Your broker may have their own minimum deposit requirements, typically ranging from $100 to $500

- Practical considerations – For effective risk management, you should have enough capital to withstand drawdowns

As a general guideline, while you can technically start with as little as $100-$200, a more practical minimum would be $500-$1,000 to adequately follow most signal providers. This allows for proper position sizing and risk management. Some high-performance signals with larger trade sizes may require $2,000 or more for effective copying.

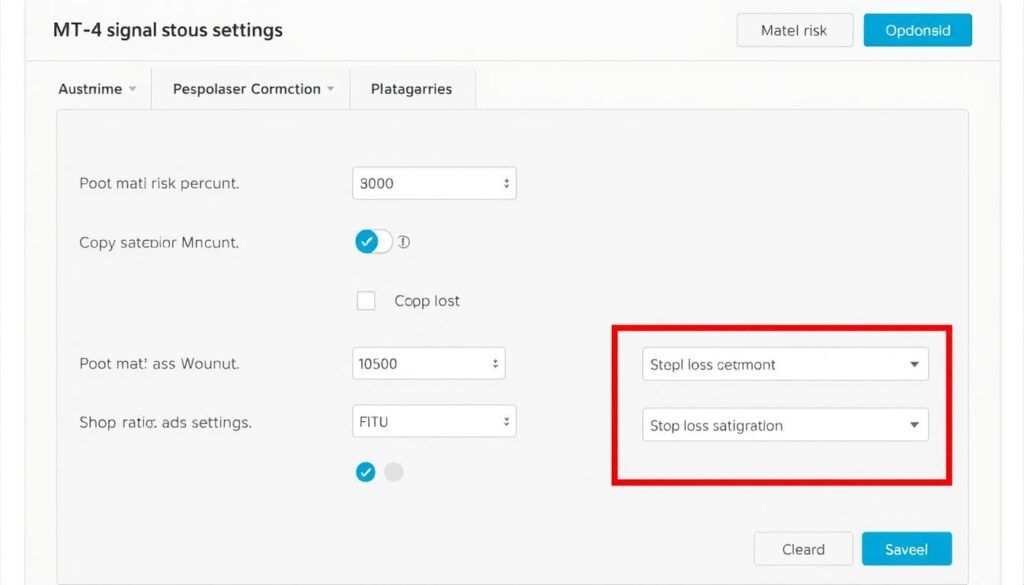

Can I customize the signal settings to match my risk tolerance and trading preferences?

Yes, MT4 offers several customization options for signal subscribers:

- Copy ratio – Adjust the volume of copied trades relative to the signal provider (e.g., copy at 50% to trade half the provider’s volume)

- Maximum deposit percentage – Limit how much of your deposit can be used for copying trades

- Copy stop levels – Choose whether to copy the provider’s stop-loss and take-profit levels

- Selective copying – Some advanced setups allow you to filter which trades to copy based on specific criteria

- Synchronization mode – Choose whether to copy only new trades or also synchronize with existing open positions

These customization options allow you to tailor the signal copying experience to your risk tolerance, account size, and trading goals. You can access these settings when subscribing to a signal or modify them later through the Signals tab in your MT4 platform.

,000 to adequately follow most signal providers. This allows for proper position sizing and risk management. Some high-performance signals with larger trade sizes may require ,000 or more for effective copying.

Can I customize the signal settings to match my risk tolerance and trading preferences?

Yes, MT4 offers several customization options for signal subscribers:

- Copy ratio – Adjust the volume of copied trades relative to the signal provider (e.g., copy at 50% to trade half the provider’s volume)

- Maximum deposit percentage – Limit how much of your deposit can be used for copying trades

- Copy stop levels – Choose whether to copy the provider’s stop-loss and take-profit levels

- Selective copying – Some advanced setups allow you to filter which trades to copy based on specific criteria

- Synchronization mode – Choose whether to copy only new trades or also synchronize with existing open positions

These customization options allow you to tailor the signal copying experience to your risk tolerance, account size, and trading goals. You can access these settings when subscribing to a signal or modify them later through the Signals tab in your MT4 platform.

Conclusion: Transforming Your Trading with MT4 Signals and Automatic Execution

MetaTrader 4 Trading Signals with Automatic Execution represent a powerful tool for traders seeking to leverage the expertise of professionals while minimizing the time commitment of active trading. By following the setup guide, implementing proper risk management strategies, and selecting reliable signal providers, you can potentially enhance your trading results while freeing up valuable time.

Remember that while automated signal execution offers many advantages, it’s still important to regularly monitor performance, adjust your strategy as needed, and maintain realistic expectations. No trading approach is entirely risk-free, but MT4 signals provide a structured, disciplined method to participate in financial markets with the guidance of proven strategies.

Ready to Automate Your Trading?

Start copying professional traders today and experience the benefits of MetaTrader 4 Trading Signals with Automatic Execution.